As the government accelerates plans to cut carbon emissions during the coronavirus pandemic, multinational oil and gas company, BP, has forecasted lower oil prices in the decades ahead.

The energy giant has cut price forecasts by as much as 30%, with it expecting Brent crude oil to average $55 per barrel up until the year 2050. This has meant that the firm will revise down the value of its assets by between $13bn and $17.5bn (£13.8bn). Moving forwards, the oil giant stated it would be a “leaner, faster-moving and lower cost organisation”. Earlier in June, BP made it clear that it was to cut 10,000 jobs, primarily due to a plummeting demand for oil across the world.

As governments enforced lockdowns all over the world, many citizens were ordered to stay in their homes and work from home where possible. This had a severe impact on business activity and the number of vehicles on the roads fell massively, meaning less fuel was needed. At the peak of the coronavirus crisis, oil prices fell to less than $20 per barrel, this figure meant that it cost less than one third of the usual $66 market price seen at the start of 2020.

Remarkably, many buyers were even paid to accept crude oil and were encouraged to do so as there were logistical issues around storage. Since then, the price has now partially recovered to around $37 per barrel, although it will still be some time before it can bounce back to previous rates. This will also have a knock-on effect on wholesale gas and electricity prices in the future.

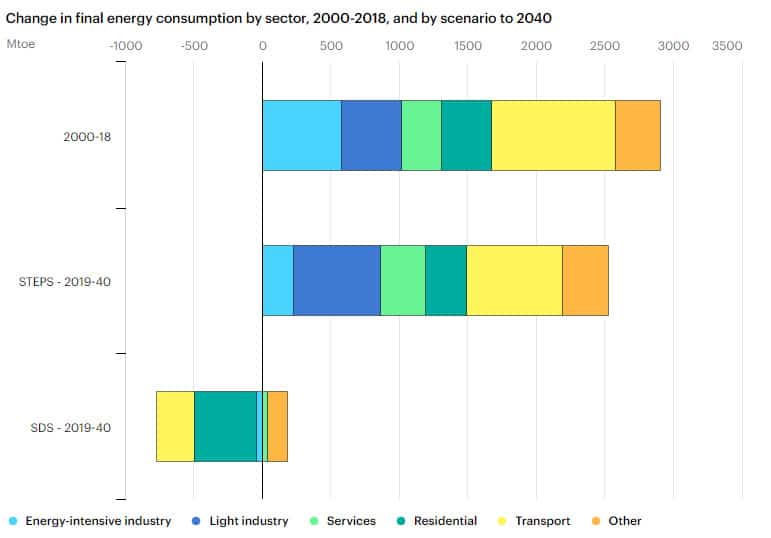

BP has said it has “a growing expectation that the aftermath of the pandemic will accelerate the pace of transition to a lower carbon economy and energy system, as countries seek to ‘build back better’ so that their economies will be more resilient in the future”.

This is strictly a strategic business move by the oil giant as the North Sea isn’t easy to exploit due to the costs involved. Although, the effects on our climate could be significant. Many environmental experts have previously warned that companies have already found an excess in oil which we should avoid burning to protect the planet. At this point in history, it will be interesting to see how firms respond to these new changes, especially as green initiatives pick up speed.

Oil prices will remain lower for a longer period. As governments focus their efforts on rebuilding their economies, a faster transition to low carbon energy sources could take place. Many energy suppliers already offer renewable tariffs, and these will only increase in popularity.

As we move forward, it will be interesting to see if other large oil companies also take similar action.